take home pay calculator manitoba

Assuming you earn Manitobas minimum hourly rate of 1195 work an average of 35 hours per week over 48 weeks per year you would earn 20076 per year. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget.

Manitoba Pnp Funds Requirement 2019 Manitoba Free Assessments Saskatchewan

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

. Enter your salary into the calculator above to find out how taxes in Manitoba Canada affect your income. You assume the risks associated with using this calculator. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location.

It can also be used to help fill steps 3 and 4 of a W-4 form. Anonymous accurate FREE way to quickly calculate the termination pay severance package required for an Ontario BC Alberta employee let go from a job. Also known as Gross Income.

How much tax do you pay when you sell a house in Manitoba. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. Your Results Total income 0 Total tax 0 After-tax income 0 Average tax rate 000 Marginal tax rate 2580 Summary.

Your average tax rate is 2758 and your marginal tax rate is 3600. Enter the number of hours worked a week. Why not find your dream salary too.

Enter your pay rate. Real tax rate 273 So with you and the employer both paying tax what used to be a 22 tax rate now rises to 273 meaning your real tax rate is actually 53 higher than what it seemed at first. Throughout Canada the minimum wage is defined instead as an hourly rate.

This calculator is intended for use by US. Province of residence Employment income Self-employment income Other income incl. That means that your net pay will be 35668 per year or 2972 per month.

Salaried employees can enter either their annual salary or earnings per pay period. British Columbia Alberta Saskatchewan Manitoba Ontario New Brunswick Nova Scotia Prince Edward Island Newfoundland Yukon Northwest Territories Nunavut. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332. Take Home Pay Calculator by Walter Harder Associates. Your average tax rate is 314 and your marginal tax rate is 384.

The Manitoba Income Tax Salary Calculator is updated 202223 tax year. How to calculate annual income. Were making it easier for you to process your payroll and give your employees a great experience with their payslips.

It will confirm the deductions you include on your official statement of earnings. If you make 10000000 a year Alberta you will be taxed 2758222. It costs the employer 3793 to pay you 52000.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related. The Viventium Paycheck Calculator is a free tool that will calculate your net or take-home pay.

Take-home pay or wages are what is left over from your wages after withholdings for taxes and deductions for benefits have been taken out. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The marginal tax rate for first 30000 is 0 on the next 60000 is 05 on the next 60000 is 1 and so on. The calculator is updated with the tax rates of all Canadian provinces and territories. The Manitoba Income Tax Salary Calculator is updated 202223 tax year.

In other words every time you spend 10 of your hard-earned money 293 goes to the government. This is required information only if you selected the hourly salary option. Salary Before Tax your total earnings before any taxes have been deducted.

Take-Home Pay in Canada Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. A take home pay calculator Manitoba can help you calculate your take-home income. The amount can be hourly daily weekly monthly or even annual earnings.

Your take home salary is. If You are looking to calculate your salary in a different province in Canada you can select an alternate province here. Youll then get a breakdown of your total tax liability and take-home pay.

Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children Spouse. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. That means that your net pay will be 7241778 per year or 1200 per month.

Note that there is no defined annual minimum salary for an employee in Manitoba. CERB RRSP contribution Capital gains Income taxes paid Calculate Estimated amount 0 Federal and Provincial tax brackets. 2021 free Manitoba income tax calculator to quickly estimate your provincial taxes.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. This marginal tax rate means that your immediate additional income will be taxed at this. When you sell a house in Manitoba you pay the land transfer tax on marginal tax rates.

Use smartassets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The average monthly net salary in canada is around 2 997 cad with a minimum income of 1 012 cad per month. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021.

Pin On Winnipeg Manitoba Etsy Shops Sellers

Birth Chart Calculator Birth Chart Chart Free Birth Chart

Pin On Canadian Real Estate News

Canadian Income Tax Rules For Entertainment And Meal Expenses Branding Photoshoot Inspiration Tax Tax Rules

2022 Manitoba Tax Calculator Ca Icalculator

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

The Landlord S Itemized List Of Common Tenant Deposit Deductions Being A Landlord Rental Property Investment Rental Property Management

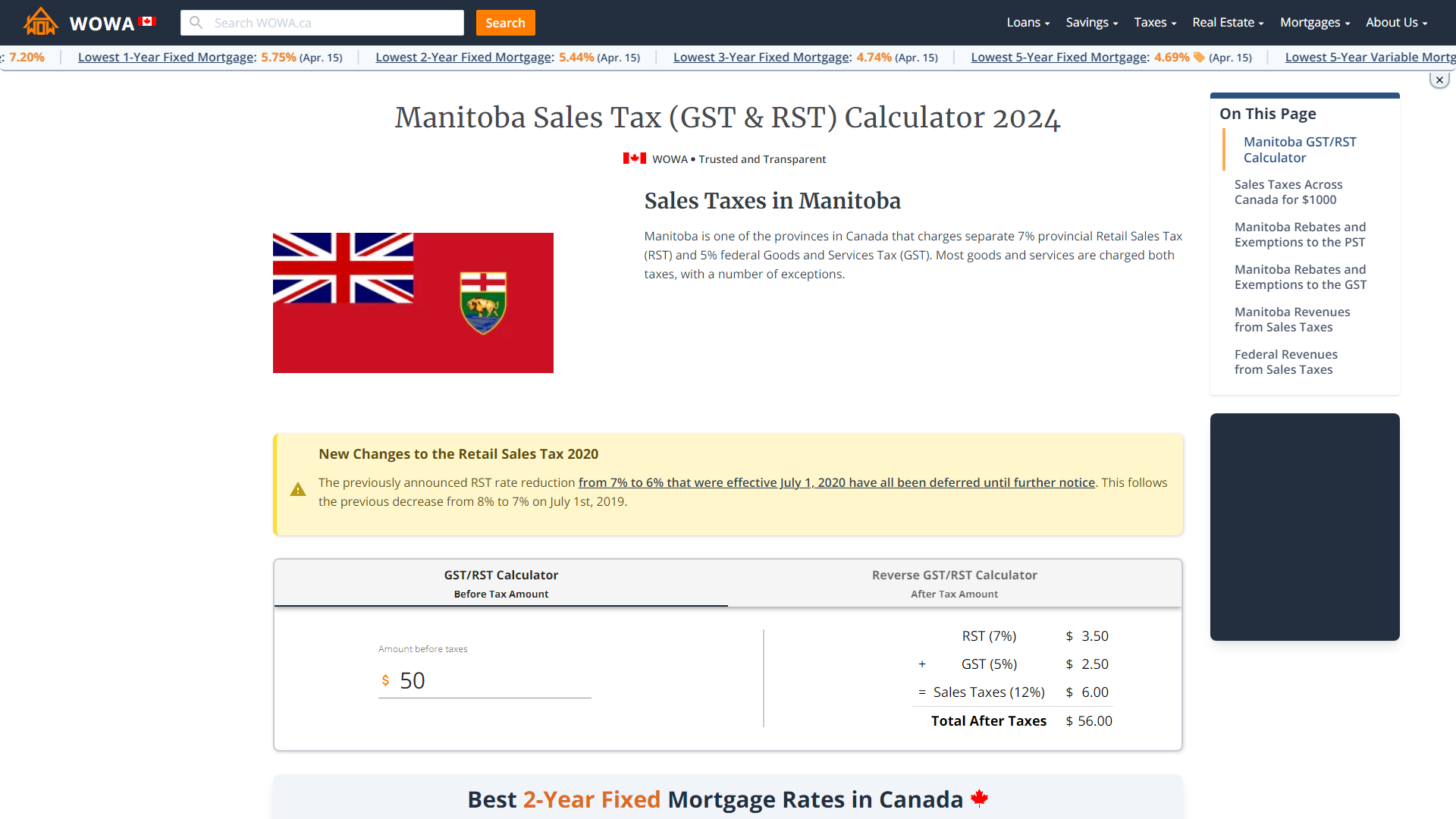

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Wedding Inviations By Empireinvites Ca Winnipeg Manitoba Canada Wedding Inviations Invitations Wedding Invitation Wording

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

We Buy Houses In Bowie Sell My House Fast We Buy Houses Home Buying

Manitoba Property Tax Rates Calculator Wowa Ca

The 2022 Canadian Stat Holiday Guide For Restaurant Owners

Manitoba Income Tax Calculator Wowa Ca